1

Please refer to important disclosures at the end of this report

1

1

Spandana Sphoorty Financial (SSFL) was established in 2003 and got registered

as an NBFC in 2004. The company provides microfinance largely to women from

lower-income households with an average loan size of `17,768/customer, in

which it follows ‘joint liability group’ model. It also follows a diversified lending

and borrowing strategy. It has wide presence in the nation with presence across

16 states and 1 union territory. Spandana stands as the 4th largest NBFC-MFI

nationally in terms of AUM with a size of `4,437Cr in FY2019.

Continuous improvement in performance: By March 2010, SSFL was the 2nd

largest MFI in India in terms of AUM and borrowers. In October 2010, the MFI

industry was severely impacted due to external regulatory action (govt. of formerly

unified Andhra Pradesh promulgated AP Microfinance Ordinance 2010),

enforcing several restrictions on the operations of MFIs. This, severely affected

Spandana’s collections and the consequent cash-flow shortage impacted its ability

to service debt, impairing SSFL’s growth. Hence, SSFL’s lenders moved the

company into CDR (Corporate debt restructuring). However, SSFL continued its

efforts and turned profitable by 2014. SSFL also received capital infusion from its

Corporate Promoter and Kedaara AIF–1, enabling it to exit from CDR mechanism

successfully. Since exit from CDR, SSFL has improved on all parameters like avg.

effective cost of borrowing declined from 16.3% to 12.3%; PAR 0+ reduced from

`139.1cr to `38.3cr; and AUM grew at CAGR of 52% over FY2017-19.

Credit rating upgrade post listing to help reduce cost of borrowing: In FY2017,

SSFL did not have a credit rating, however, in August 2017 it received a rating of

BBB-, and since then the rating kept on improving and now it stands at A-. We

believe that post listing there is a strong possibility of a rating upgrade, which will

help to reduce the incremental cost of borrowing.

Diversified AUM across 17 states and opportunity to cater unbanked population:

SSFL’s operation is well spread across 17 states with 929 branches. No single

state/district/branch contributes more than 20%/1.8%/0.3% to the AUM as of

March 2019. Average loan per borrower is at ~`17,800 vs. close peers at more

than `25,000, which clearly shows management’s conservative approach and

clears risk diversification by limiting AUM by state/ district /branch.

Outlook & Valuation: At upper end of the price band, SSFL is valued at 2.7x of

FY2019 BV (Pre-IPO) and on post dilution basis at 2.4x of Book value, whereas

close peers i.e. CreditAccess Grameen is trading at 3x FY2019 BV. Given SSFL’s

successful exit from CDR in March 2017, healthy NIM, return ratio and low

penetration of financial services in rural India coupled with a well-capitalised

balance sheet and experienced management; we believe the company has an

excellent base for next level of growth. Based on the positive factors, we assign

SUBSCRIBE rating to the issue.

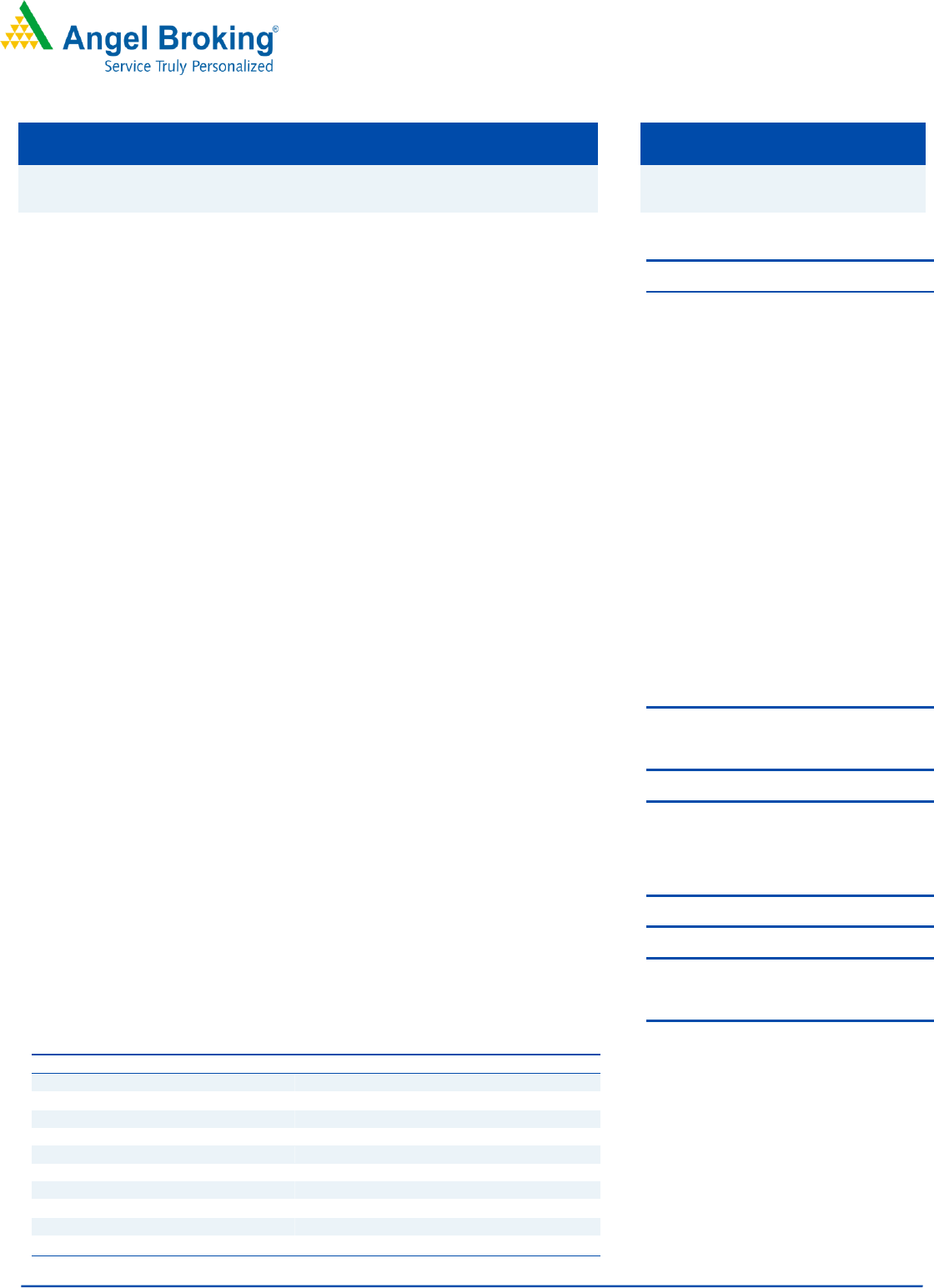

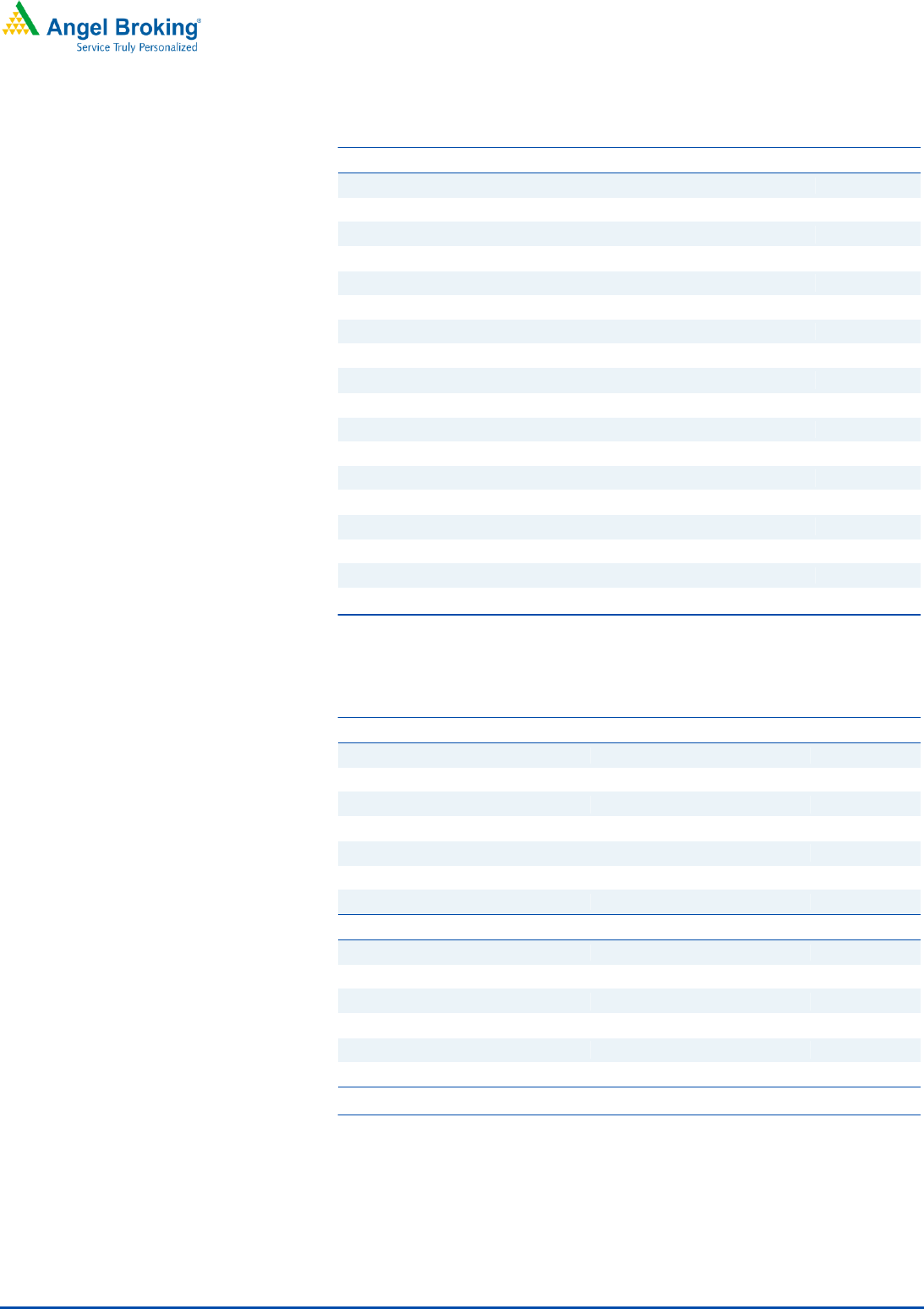

Exhibit 1: Key Financial

Y/E March (` cr)

FY17

FY18

FY19

NII

221.2

335.7

646.5

YoY Growth (%)

51.8

92.6

PAT

432.8

187.3

311.8

YoY Growth (%)

(56.7)

66.5

EPS

72.6

31.4

52.3

Book Value

155.5

233.2

317.0

P/E

11.8

27.3

16.4

P/BV

5.5

3.7

2.7

ROE (%)

50.7

19.0

21.5

ROA (%)

36.2

10.3

9.6

Note - Valuation done on pre IPO financials

SUBSCRIBE

Issue Open: Aug 05, 2019

Issue Close: Aug 07, 2019

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 63%

Others 37%

Post Issu e Sh areholding Pattern

Post Eq. Paid up Capital: `64.3cr

Issue size (amount): *`1,198cr -

**1,201 cr

Price Band: `853-856

Lot Size: 17 shares and in multiples

thereafter.

Post-issue implied mkt. cap: *`5,485cr

- **`5,504cr

Promoters holding Pre-Issue: 81.20%

Promoters holding Post-Issue: 62.59%

*Calculated on lower price band

** Calculated on upper price band

Book Bu ildin g

Fresh issue: ` 400cr

Issue D etails

Face Value: `10

Present Eq. Paid up Capital: `59.6cr

Offer for Sale: **0.94cr Shares

Jaikishan J Parmar

Research Analyst

+022 39357600, Extn: 6810

Jaikishan.parmar@angelbroking.com

Spandana Sphoorty Financial Limited

IPO Note | Financials

Aug 03, 2019

2

Spandana Sphoorty Financial Limited I PO Note

Aug 03, 2019

2

Company Background

Spandana Sphoorty Financial (SSFL) is an NBFC-MFI, which was incorporated as a

company in 2003. Later in 2004, the company got registered as an NBFC with the

RBI and subsequently in 2015 it turned into an NBFC-MFI. It offers loan to women

from low-income households and follows a ‘joint liability group’ model. As of 31

March 2019, Spandana was the fourth largest NBFC-MFI in India in terms of AUM

with a size of `4,437Cr. Of the total AUM 88% of the lending is in the rural areas.

It operates in 929 branches across16 states and 1 union territory. In none of the

branches does it concentrate more than 0.3% of its AUM. This diversification in

lending reduces credit risk for the company. Further, its borrowing is also

diversified which helps it balance its borrowing cost.

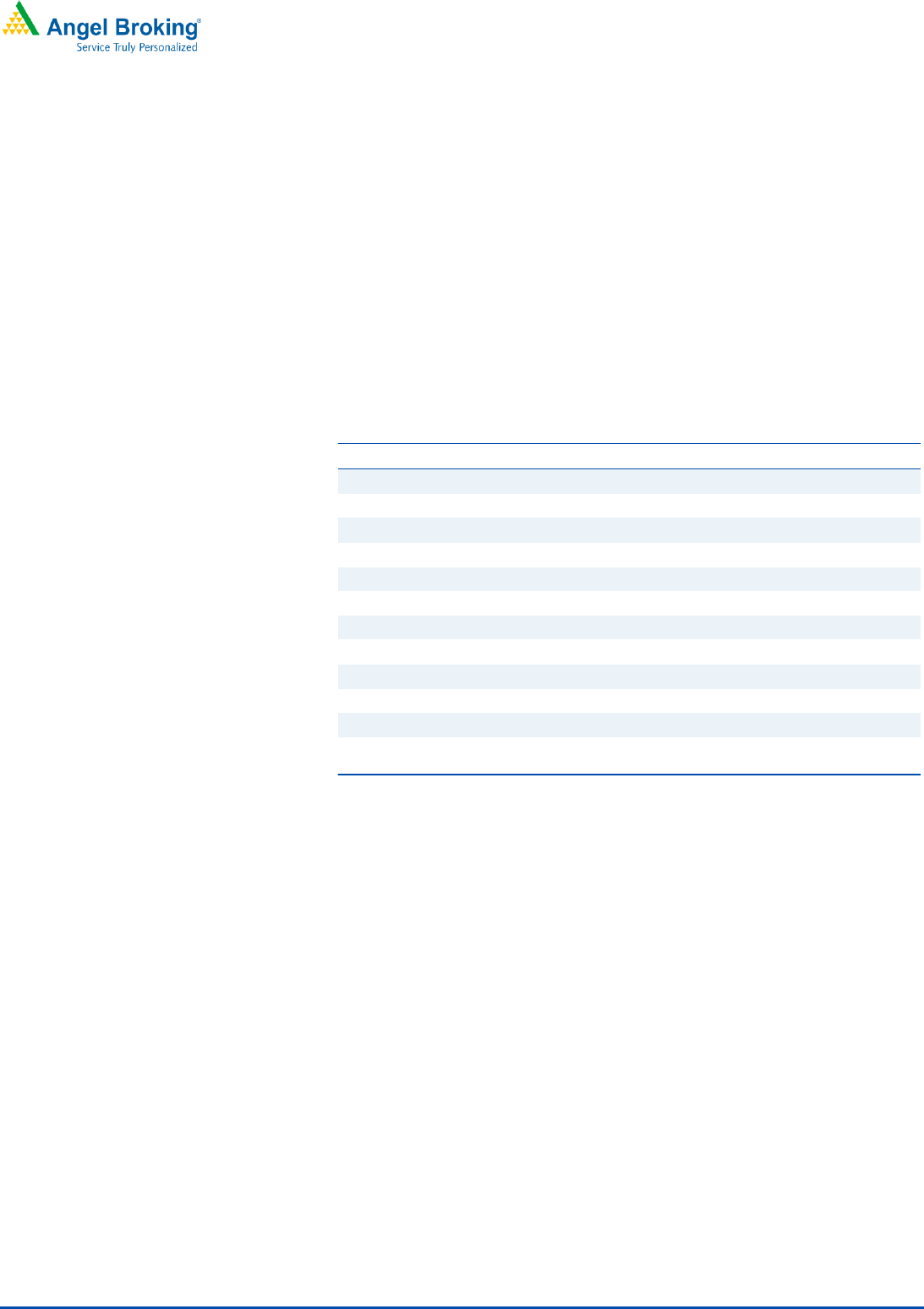

Exhibit 1: Strong performance in just 24 months since CDR exit

Particular

Mar'17

Mar'19

Gross AUM (` Cr)

1,302

4,437

Net worth (` Cr)

928

1,889

PAR 0+ (` Cr)

139

38

Profit Before Tax (` Cr)

46

474

Cost-Income Rati o (%)

41.8

24.9

No. of lender s (x)

3

28

Avg. Eff. Borrowing Cost (%)

16.3

12.8

Credit Rating

NA

A- (Stable)

Avg. Eff. Borrowing Cost (%)

16.3

12.8

Exit from

CDR)

(4th largest

NBFC-MFI in India)

Source:RHP

Key Management Personnel:

Padmaja Gangireddy is the Promoter and Managing Director of the company. She

also serves as a director on the board of directors of Caspian Financial Services

Limited. She has been a Director on the Company Board since April 19, 2003. She

founded Spandana Rural and Urban Development Organisation (“SRUDO”) in

1998.

Sudhesh Chandrasekar is the Chief Financial Officer of the Company. He holds a

post graduate diploma in management from the Indian Institute of Management,

Bangalore and a bachelor’s degree in commerce (honours) from Shri Ram College

of Commerce, University of Delhi, Delhi. Prior to joining the Company he worked

with Unitus Capital and with ICICI Bank . Mr. Sudhesh Chandrasekar joined SSFl

on August 17.

Abdul Feroz Khan is the Chief Strategy Officer of the Company. He holds a

masters’ degree in business administration from Institute of Chartered Financial

Analysts of India University, Dehradun. He joined Company on November 10,

2008 as an assistant finance manager and was designated as Chief Strategy

Officer on May 15, 2018.

3

Spandana Sphoorty Financial Limited I PO Note

Aug 03, 2019

3

Issue details

This IPO is a mix of OFS and issue of fresh shares. The issue would constitute

fresh issue worth `400cr and OFS worth `801cr. OFS largely would offer

partial exit to investors (Kedaara Capital, Helion Venture Partners, V aliant

Mauritius Partners) and Promoter Padmaja Gangireddy.

Under the OFS, the promoters and other investors are offering 9.3 million

equity shares worth `800Cr.

Exhibit 2: Pre and Post-IPO shareholding pattern

Particular

No of shares

(Pre-issue)

%

No of shares

(Post-issue)

%

Promoter

4,84,31,819

81.2

4,02,45,099

62.59

Investor/Public

1,11,97,364

18.8

2,40,56,981

37.41

5,96,29,183

100.0

6,43,02,080

100.00

Source: RHP Note: Calculated on upper price band

Exhibit 3: Selling Shareholder

Shareholder

Shares Offered

Kangchenjunga Limited

59,67,097

Padmaja Gangireddy

14,23,114

Vijaya Siva Rami

7,96,509

Valiant Mauritius Partners

7,83,747

Helion Venture Partners

1,32,831

Kedaara Capital

1,29,732

Helion Venture Part

1,23,695

Total shares

93,56,725

Source: Company

Objects of the offer

The Net Proceeds of the Fresh Issue are proposed to be utilised for

augmenting capital base and general corporate purposes.

To achieve the benefits of listing the Equity Shares on the Exchanges and to

carry out offer for sale of equity shares

Risk

The operations are concentrated to five states (72% of AUM) and any adverse

sustained economic downturn and political unrest/disruption could change

repayment behaviour of the borrowers.

Unsecured Portfolio –SSGL`s operations involve transactions with relatively

high risk borrowers (Unsecured Loan). Any default from the customers could

adversely affect the business, operations and financial condition.

4

Spandana Sphoorty Financial Limited I PO Note

Aug 03, 2019

4

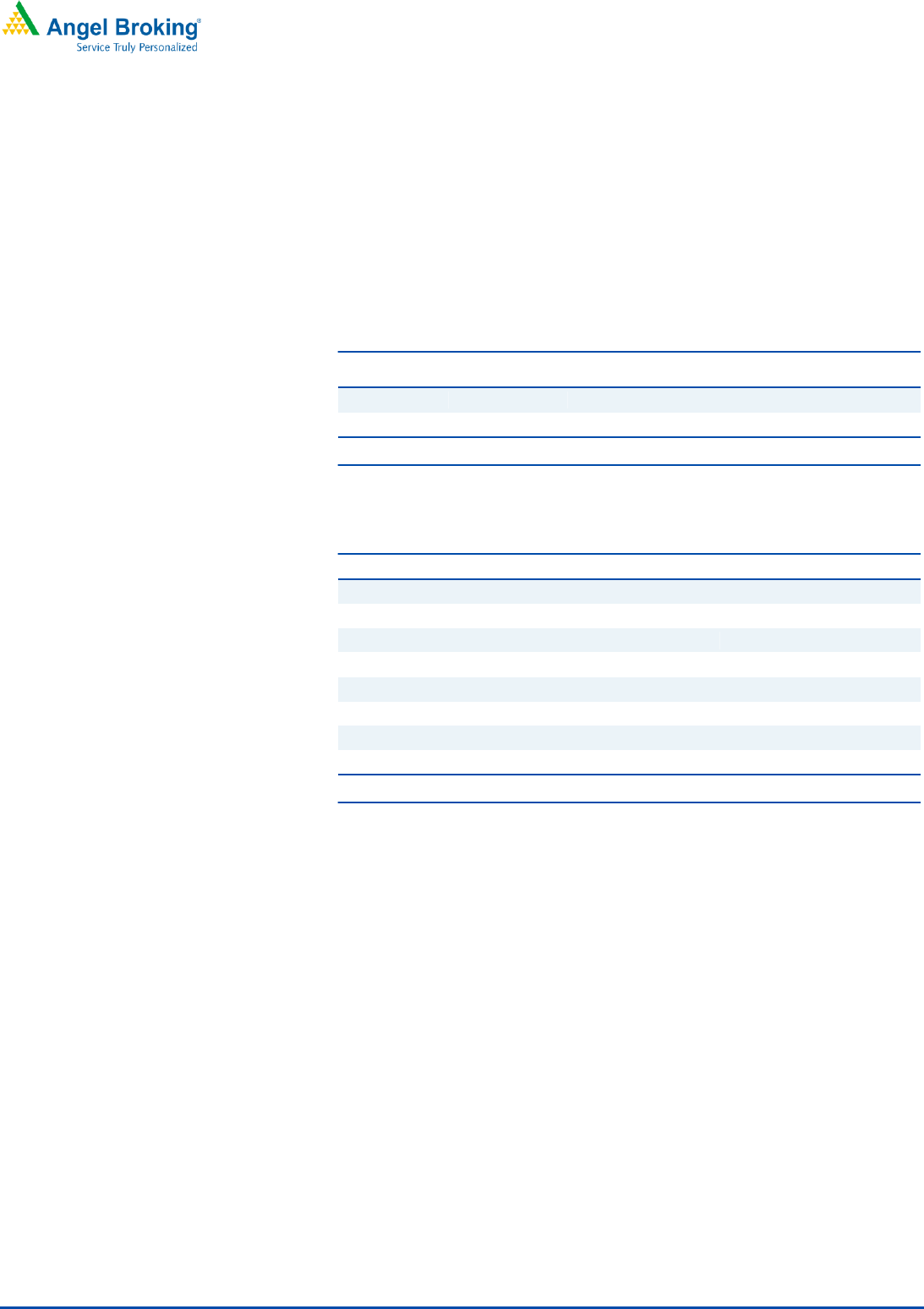

Exhibit 4: Relative Valuation

Particular

M.cap

AUM

M.cap/

AUM

P/B

P/E

AUM

Growth

ROA

ROE

Leverage

CRAR

FY19

YoY

3 Year

FY19

FY19

Spandana

5,505

4,270

1.29

2.4

18

35

52

8.5

19

2.2

40

CreditAccess Grameen

7,198

7,160

1.01

3.0

22

44

43

5.2

17

3.3

36

Bharat Fin

12,596

17,390

0.72

3.0

13

38

31

9.0

27

3.0

50

Credit Satin

1,398

6,730

0.21

1.2

7

33

27

3.1

20

6.5

28

Ujjivan Small Fin

3,948

11,050

0.36

2.1

26

46

27

1.3

8

6.5

19

Bandhan Bank

57,299

34,700

1.65

4.7

29

69

41

3.9

19

4.9

29

Source: Company, Spandana P/B valuation has done considering fresh issue; All other stock Market cap is based on 02/8/2019 and for BFIL last trading

day Mcap.

Exhibit 5: Operational Parameter

Particular

Advance Per

Borrower

AUM Per

Branch

AUM Per

AUM

GNPA/NPA

(%)

` in Cr

` in Cr

FY17

FY18

FY19

Spandana Sphoorty Fin Ltd

17,792

4.7

0.66

42.1/2.9

25.9/0.3

7.9/0

CreditAccess Grameen Ltd

28,640

10.7

0.89

0.1/0

0.8/0

0.6/0

Bharat Fin

23,500

10.1

0.90

6/2.7

2.4/1

0.8/0.2

Credit Satin

21,710

6.9

0.65

14.4/12.8

4.4/2.6

3.9/2.4

Ujjivan Small Finance Bank

27,625

21.1

0.75

0.3/0

0.36/0.7

0.9/0.3

Source: Company, All operation parameter based on FY19 financials

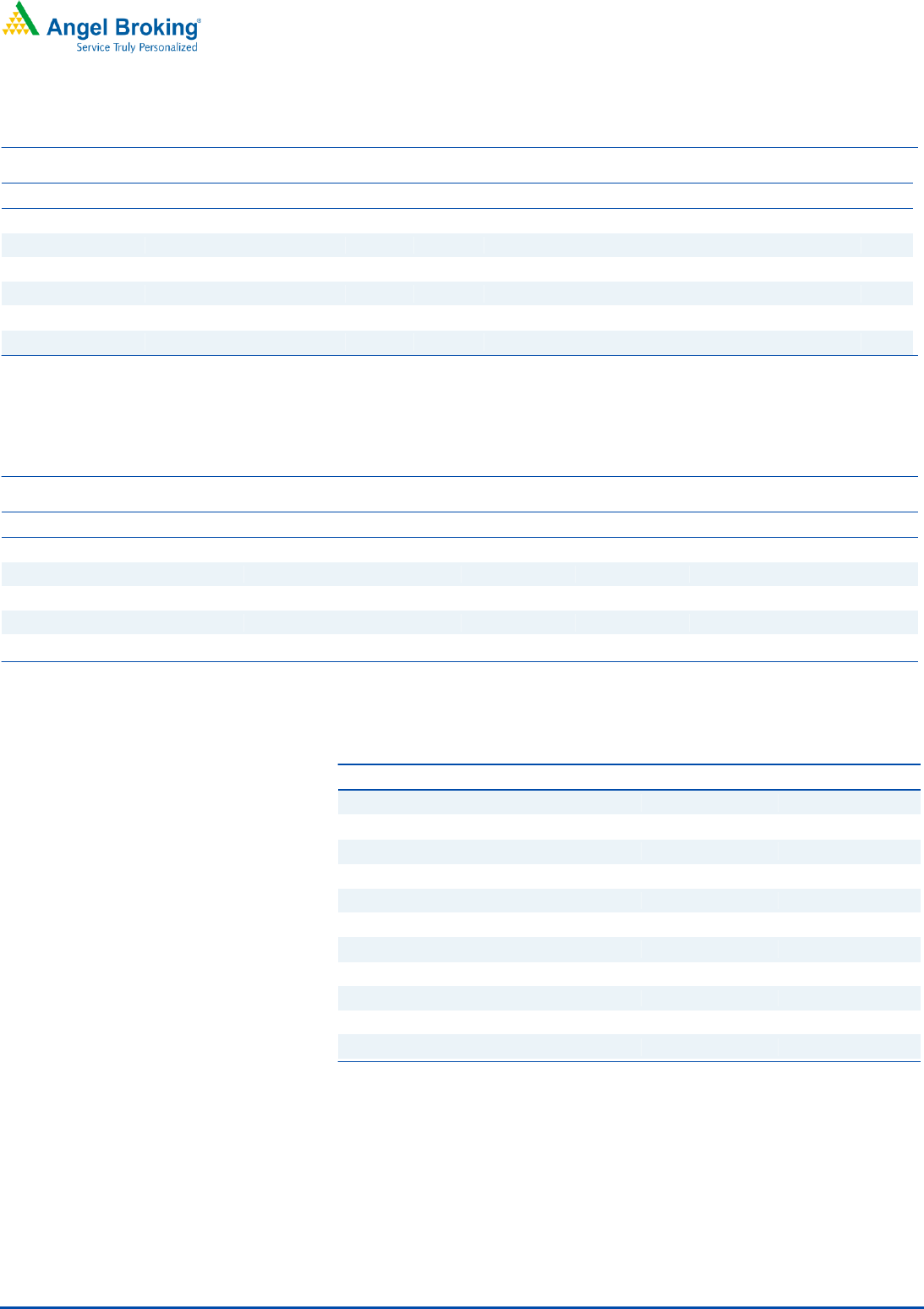

Exhibit 6: Du Pont Analysis for FY19

DuP ont Analysis

BFIL

Cre.Access

Spandana

NII

12.11

12.86

17.57

Provision

0.66

1.20

1.23

Adj NII

11.45

11.66

16.34

Other Inc.

8.38

1.04

1.20

Total Income

19.83

12.70

17.54

Opex

8.13

4.71

3.56

PBT

11.71

7.99

13.98

Taxes

2.83

2.82

4.39

RoA

8.88

5.17

9.59

Leverage

3.01

3.28

2.24

RoE

26.75

16.94

21.50

5

Spandana Sphoorty Financial Limited I PO Note

Aug 03, 2019

5

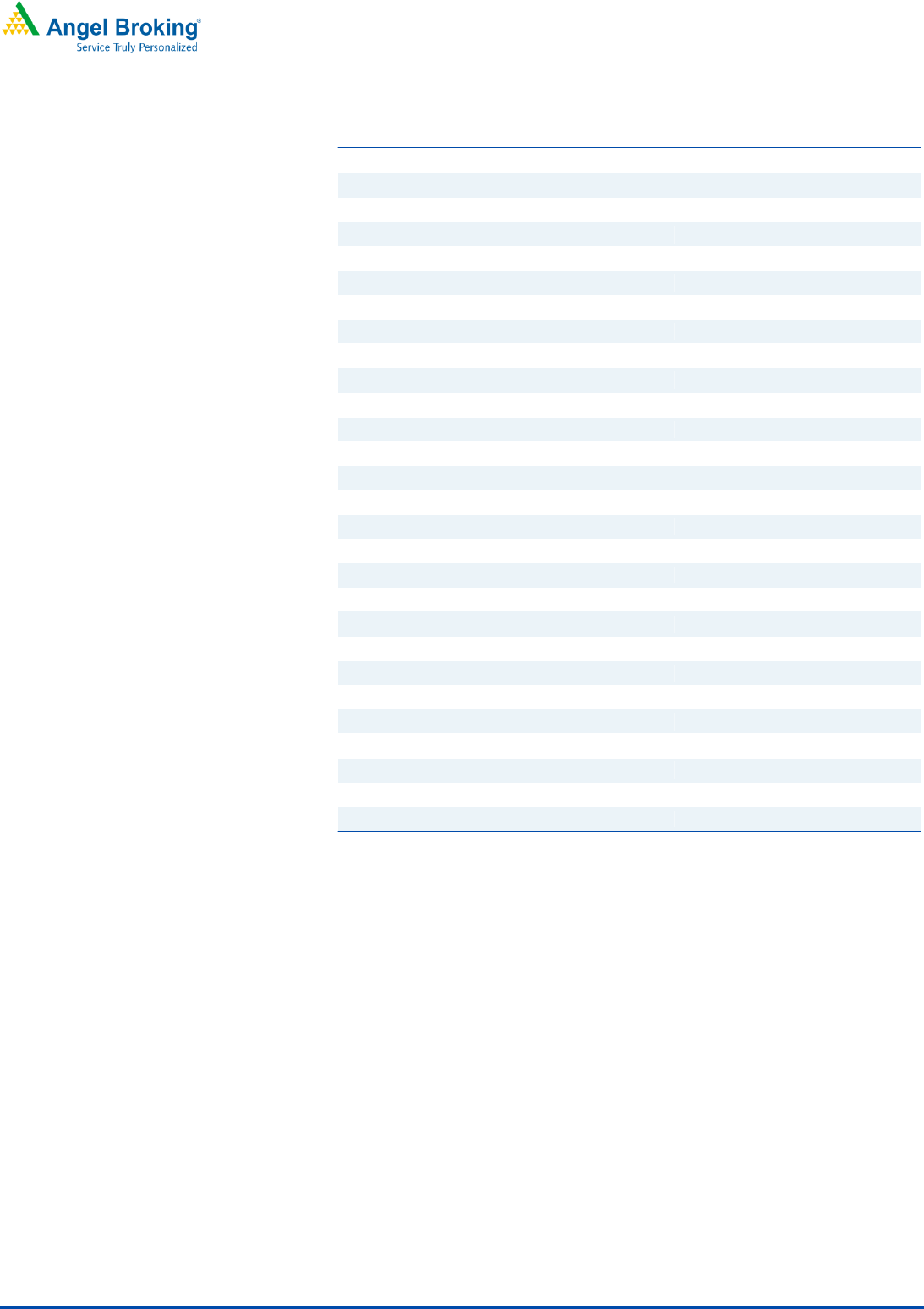

Income Statement

Y/E March (` cr)

FY17

FY18

FY19

NII

221.2

335.7

646.5

- YoY Growth (%)

51.8

92.6

Other Income

8.0

19.3

44.2

- YoY Growth (%)

141.3

128.8

Operating Income

229.2

355.0

690.6

- YoY Growth (%)

54.9

94.5

Operating Ex penses

95.8

108.5

171.9

- YoY Growth (%)

13.2

58.5

Pre - Provision Profit

133.4

246.6

518.7

- YoY Growth (%)

84.8

110.4

Prov. & Cont.

98.4

(35.4)

45.3

- YoY Growth (%)

(136.0)

(228.0)

Profit Before Tax

35.0

282.0

473.4

- YoY Growth (%)

705.6

67.9

Prov. for Taxation

(397.8)

94.7

161.6

-

PAT

432.8

187.3

311.8

- YoY Growth (%)

(56.7)

66.5

Balance Sheet

Y/E March (` cr)

FY17

FY18

FY19

Share Capital

28

30

60

Reserve & Surplus

899

1,361

1,831

Net Worth

928

1,391

1,890

Total Borrowings

959

2,346

3,012

- Growth (%)

145

28

Total provisions

1

0

0

Other Liabilities

41

27

29

Total Liabilities

1,929

3,764

4,932

Cash and Cash equivalents

290

105

149

Investments

4

169

264

Total Loans & Advances

1,195

3,090

4,268

- Growth (%)

159

38

Fixed Assets

9

9

27

Other Assets

431

392

225

Total Assets

1,929

3,764

4,932

6

Spandana Sphoorty Financial Limited I PO Note

Aug 03, 2019

6

Key Ratio

Y/E March

FY17

FY18

FY19

Profitability ratios (%)

NIMs

18.5

15.1

16.6

RoA

36.2

10.3

9.6

RoE

50.7

19.0

21.5

C/I

41.8

30.6

24.9

Asset Quality (%)

Gross NPAs %

42.0

25.9

7.9

Net NPAs %

2.9

0.3

-

Credit Cost

8.2

(1.1)

1.1

Per Share Data (`)

EPS

72.6

31.4

52.3

BVPS

155.5

233.2

317.0

Valuation Ratios

PER (x)

11.8

27.3

16.4

P/BVPS (x)

5.5

3.7

2.7

DuPont Analy sis

NII

17.0

15.7

17.6

Provision

7.6

(1.7)

1.2

Adj NII

9.4

17.3

16.3

Other Inc.

0.6

0.9

1.2

Total Income

10.0

18.2

17.5

Opex

4.5

3.5

3.6

PBT

5.6

14.7

14.0

Taxes

(30.6)

4.4

4.4

RoA

36.2

10.3

9.6

Leverage

1.4

1.8

2.2

RoE

50.7

19.0

21.5

Note: Calculations based on higher end of the price band – ₹856 and without considering fresh

issue.

7

Spandana Sphoorty Financial Limited I PO Note

Aug 03, 2019

7

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has n ot

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other rel iable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingl y, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document . While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this mat erial, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may ari se from or in

connection with the use of this information.